What is dollar cost averaging?

Dollar Cost Averaging (DCA) is a method where instead of investing all of your capital at one point in time, you spread out your investment purchases over a period of time to reduce risk of investing at the wrong time.

What is the theory behind it?

The theory is that with a lump sum investment, you can lose a major amount of your investment if the market tanks shortly after purchase. With DCA, you would have only invested a little bit of your capital during the down turn, and you would subsequently buy more when the market is at a lower value. This ultimately leads to losing less capital because you had less invested during the downturn. However, as you may have guessed, you will receive the opposite result during an upswing in the market.

Examples

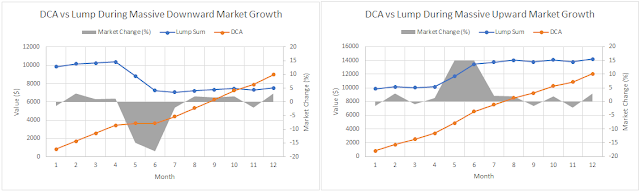

Below I will go through some market examples to better help illustrate the difference between investing all at once (lump sum) and DCA. For each example, the investor will have $10,000 to spend over a year and will invest it all at once for lump sum, or will invest $10,000 / 12 for each month with DCA.

Example 1: Simple Cases

For the simple case of positive market growth, the lump sum method is superior due to more capital being invested for a longer period of time. However, during negative market growth, DCA method wins out due to less money invested in the shrinking market. You should take care to notice that both DCA and Lump Sum method in the negative market growth method resulted in having less than $10,000.

Example 2: Varied Market Growth

During varied market growth, which contain the cases that are most interesting, the results are more meaningful. In the top left graph, where the market is first positive then negative, lump sum will win out due to greater growth during the positive market gains. However, if the negative market trend continues on, then DCA will win out as in example 1. In the top right graph, with negative market growth then positive growth, DCA wins out due to less capital invested in the downwards market. Finally, in the bottom graph, where the market growth is rapidly up and down, the methods even out to nearly the same result.

Example 3: Large market value swings

Finally, we have the methods compared during a large market swing. As you may be able to predict by now, DCA will win out if there is negative market growth and the lump sum method will win during positive market growth.

Conclusion

In conclusion, DCA is a method that can be used to negate risk during potential negative market growth, while lump sum is the method best used during positive market growth. Ultimately, it comes down to trying to time the market which is a best a gamblers game.